房产抵押不需要配偶签字有哪些银行

Certainly! Here's a structured outline for your thesis proposal, focusing on the topic "Real Estate Mortgage Without Spousal Signature":

Title:

Exploring the Legal and Financial Implications of Real Estate Mortgage Without Spousal Signature Requirement

Introduction:

In the realm of real estate transactions, the requirement for spousal consent or signature for property mortgages has been a longstanding practice. However, recent legal developments and shifts in societal norms have raised questions about the necessity and implications of this requirement. This study aims to investigate the feasibility and implications of eliminating the spousal signature requirement in real estate mortgage transactions.

Research Purpose and Significance:

The primary purpose of this research is to critically analyze the necessity and impact of spousal consent requirements in real estate mortgage transactions. By examining legal frameworks, financial implications, and societal perspectives, this study seeks to provide a comprehensive understanding of whether such requirements are justified or obsolete in contemporary legal and social contexts.

The significance of this research lies in its potential to influence legal reforms and financial practices related to real estate transactions. By providing empirical evidence and thorough analysis, this study aims to inform policymakers, legal professionals, and stakeholders in the real estate industry about the implications of spousal consent requirements.

Literature Review:

Historical Perspective:

Evolution of spousal consent requirements in property law.

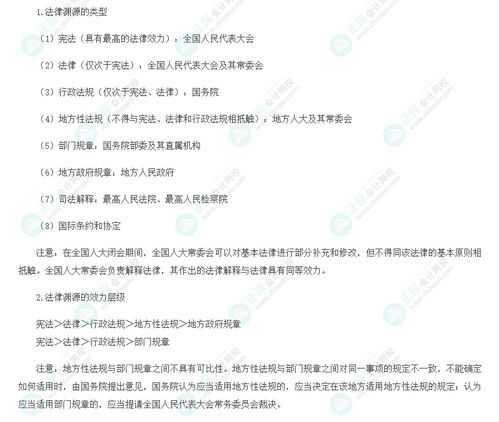

Legal Frameworks:

Comparative analysis of jurisdictions with and without spousal signature requirements.

Financial Impact:

Effects on mortgage accessibility, market dynamics, and economic implications.

Social and Gender Perspectives:

Influence on marital dynamics, gender equality, and individual property rights.Methodology:

This study will employ a mixedmethods approach:

Quantitative Analysis:

Statistical analysis of mortgage approval rates and financial outcomes in jurisdictions with and without spousal signature requirements.

Qualitative Research:

Interviews with legal experts, financial advisors, and individuals involved in real estate transactions to gather perspectives on the practical implications.Expected Results:

Based on the analysis of literature and empirical data, the study expects to find:

Insights into the legal and financial implications of spousal consent requirements.

Evidence regarding the impact on mortgage accessibility and market dynamics.

Perspectives on the relevance of these requirements in modern marital and legal contexts.

Conclusion:

The findings of this study will contribute to the ongoing discourse on property rights, marital dynamics, and legal reforms related to real estate transactions. By evaluating the necessity of spousal consent requirements, this research aims to provide actionable insights for policymakers, legal professionals, and stakeholders in the real estate industry.

Keywords:

Real estate, mortgage law, spousal consent, property rights, legal reform, financial implications.

This proposal outline is designed to provide a clear structure for your thesis on the topic of real estate mortgages without spousal signature requirements. Adjustments can be made based on specific guidelines from your academic institution or further insights from your research.